Working with a financial coach can be a valuable investment in achieving your financial goals and improving your financial well-being. Before deciding to work with a financial coach, it’s important to consider factors such as cost, financial goals, and the coach’s qualifications and experience. A good financial coach should possess skills such as knowledge of personal finance, communication and coaching skills, empathy and understanding, analytical skills, and professionalism and ethics. The responsibilities of a financial coach include developing a financial plan, providing education and guidance, setting and tracking financial goals, offering accountability and support, providing unbiased advice, and adhering to professional standards and ethics. The components of financial coaching include financial planning, education and guidance, goal setting and tracking, accountability and support, review and feedback, and behavioral change. By understanding these factors, you can make an informed decision about whether working with a financial coach is right for you.

Table of contents:

- Are financial advisors worth paying for?

- How much should I pay a financial coach?

- What is the average hourly rate for a financial coach?

- Is it worth getting a financial coach?

- How much does it cost to hire a financial coach?

- How do I choose a financial coach?

- What is a financial coach not allowed to do?

- What is the difference between a financial coach and a financial advisor?

- Should I work with a financial coach?

- Is it worth getting a financial coach?

- What are the benefits of working with a financial coach?

- Why should you hire a financial coach?

- What makes a good financial coach?

- How much should a financial coach cost?

- What skills do you need to be a financial coach?

- What are the responsibilities of a financial coach?

- What are the components of financial coaching?

Are financial advisors worth paying for?

If you’re considering working with a financial coach, one question you may have is whether financial advisors are worth paying for. The answer to this question depends on your specific needs and financial situation.

A financial advisor can provide you with expert guidance and advice on a wide range of financial topics, including investing, retirement planning, tax strategies, and risk management. They can help you create a comprehensive financial plan that takes into account your goals, risk tolerance, and time horizon. Additionally, a financial advisor can help you navigate complex financial products and regulations, and provide ongoing support and monitoring of your investments.

However, it’s important to note that financial advisors typically charge fees for their services, which can vary based on the advisor’s experience, expertise, and the level of service provided. These fees may be structured as a percentage of assets under management, a flat fee, or an hourly rate.

Before deciding whether a financial advisor is worth paying for, it’s important to consider your own financial goals and needs. If you have a complex financial situation or lack the time or expertise to manage your investments on your own, a financial advisor may be a valuable investment. Additionally, if you’re looking for ongoing support and guidance, a financial advisor can provide regular check-ins and adjustments to your financial plan.

However, if you have a relatively simple financial situation and feel confident in managing your investments on your own, you may not need the services of a financial advisor. Ultimately, the decision to work with a financial advisor is a personal one that depends on your specific financial goals, needs, and preferences. It’s important to do your research and ask potential advisors about their experience, qualifications, and fees before making a decision.

How much should I pay a financial coach?

When considering working with a financial coach, one of the most common questions people have is how much they should expect to pay. The cost of a financial coach can vary widely depending on several factors, including the coach’s experience, qualifications, and the level of service provided.

Some financial coaches charge hourly rates, while others charge a flat fee for a specific service or ongoing support. In some cases, financial coaches may charge a percentage of assets under management, particularly if they also provide investment management services.

The cost of a financial coach may also depend on the length and frequency of your sessions, as well as the complexity of your financial situation. If you have a relatively simple financial situation and only need basic guidance and education, you may be able to work with a coach on an hourly basis or pay a flat fee for a specific service. However, if you have a more complex financial situation or require ongoing support and monitoring, you may need to pay a higher fee or percentage of assets under management.

When considering how much to pay a financial coach, it’s important to keep in mind that the cost is an investment in your financial future. A good financial coach can help you achieve your financial goals, improve your financial literacy, and avoid costly mistakes that could set you back in the long run.

Before hiring a financial coach, it’s important to ask about their fees and how they are structured. You should also consider their experience, qualifications, and track record of success with clients. Ultimately, the cost of a financial coach should be reasonable and within your budget, while also providing value for the services provided.

What is the average hourly rate for a financial coach?

The hourly rate for a financial coach can vary widely depending on several factors, such as the coach’s experience, qualifications, and location. However, based on industry data, the average hourly rate for a financial coach ranges from $150 to $350 per hour.

It’s important to note that some financial coaches may charge a flat fee for a specific service or a percentage of assets under management, rather than an hourly rate. Additionally, some coaches may offer packages or ongoing support for a set fee rather than charging by the hour.

When considering working with a financial coach, it’s important to ask about their fees and how they are structured. You should also consider the value of the services provided, as well as the coach’s experience and qualifications. Ultimately, the cost of a financial coach should be reasonable and within your budget, while also providing value for the services provided.

Is it worth getting a financial coach?

Deciding whether it’s worth getting a financial coach is a personal decision that depends on your individual financial situation and goals. However, working with a financial coach can provide numerous benefits that may make it worth the investment.

A financial coach can help you:

- Set and achieve financial goals: A financial coach can help you define your financial goals and create a personalized plan to achieve them. This can help you stay focused and motivated, and avoid getting sidetracked by short-term distractions.

- Improve financial literacy: A financial coach can help you understand complex financial concepts and terminology, and provide guidance on how to manage your money effectively. This can help you make informed decisions and avoid costly mistakes.

- Develop better financial habits: A financial coach can help you develop better financial habits, such as creating a budget, saving regularly, and avoiding unnecessary spending. Over time, these habits can lead to significant improvements in your financial situation.

- Avoid common financial mistakes: A financial coach can help you avoid common financial mistakes, such as taking on too much debt or investing in high-risk products without understanding the risks involved.

- Provide accountability and support: A financial coach can provide ongoing support and accountability, helping you stay on track with your financial goals and making adjustments as needed.

Ultimately, whether it’s worth getting a financial coach depends on your individual needs and goals. If you have a specific financial goal you want to achieve, such as saving for retirement or paying off debt, or if you lack financial knowledge or discipline, a financial coach can be a valuable investment. By providing guidance, support, and accountability, a financial coach can help you achieve your financial goals and build a stronger financial future.

How much does it cost to hire a financial coach?

The cost of hiring a financial coach can vary widely depending on several factors, including the coach’s experience, qualifications, location, and the level of service provided.

Some financial coaches charge hourly rates, while others charge a flat fee for a specific service or ongoing support. In some cases, financial coaches may charge a percentage of assets under management, particularly if they also provide investment management services.

The cost of a financial coach may also depend on the length and frequency of your sessions, as well as the complexity of your financial situation. If you have a relatively simple financial situation and only need basic guidance and education, you may be able to work with a coach on an hourly basis or pay a flat fee for a specific service. However, if you have a more complex financial situation or require ongoing support and monitoring, you may need to pay a higher fee or percentage of assets under management.

Based on industry data, the average cost of hiring a financial coach can range from $100 to $400 per hour, with some coaches charging more or less than this range. It’s important to note that some coaches may offer packages or ongoing support for a set fee rather than charging by the hour.

Ultimately, the cost of hiring a financial coach will depend on your individual needs and the level of support you require. It’s important to consider the value of the services provided and whether they align with your financial goals and budget. Before hiring a financial coach, it’s important to ask about their fees and how they are structured, as well as their experience and qualifications.

How do I choose a financial coach?

Choosing a financial coach can be an important decision that can impact your financial future. Here are some common questions to ask when selecting a financial coach:

- What is their experience and qualifications? Look for a financial coach who has experience working with clients who have similar financial goals and challenges to yours. Also, ask about their educational and professional background, such as certifications or degrees in finance, accounting, or financial planning.

- What is their coaching approach? Different coaches have different approaches, so it’s important to find a coach who aligns with your personality, communication style, and learning preferences. Some coaches may use a more structured approach with specific steps and processes, while others may take a more collaborative approach with a focus on customized solutions.

- What services do they offer? Determine what type of financial services you need and ensure that the financial coach offers those services. For example, if you need help with debt management, ensure that the financial coach specializes in this area.

- How do they charge for their services? Financial coaches may charge hourly rates, flat fees for specific services, or a percentage of assets under management. Determine what payment method you are comfortable with and ensure that the coach’s fee structure aligns with your budget.

- What do their past clients say about them? Ask for references or read reviews of the financial coach’s services. This will give you insight into how they work with clients, the success of their coaching, and any potential issues that may arise.

- How will they help you achieve your financial goals? Determine how the financial coach plans to help you achieve your financial goals. Do they offer a comprehensive financial plan, provide ongoing support, or have a particular investment philosophy? Ensure that their approach aligns with your goals and values.

By asking these questions, you can make an informed decision when selecting a financial coach who can help you achieve your financial goals and build a stronger financial future.

What is a financial coach not allowed to do?

When seeking the services of a financial coach, it’s essential to understand the scope of their responsibilities. While a financial coach can provide guidance and support, there are specific limitations to their role. Here are some things a financial coach is not allowed to do:

- Offer investment advice: A financial coach is not a licensed financial advisor and cannot offer investment advice. If you need help with investments, you should seek the services of a licensed financial advisor.

- Make decisions for you: A financial coach can help you understand your financial situation, but they cannot make decisions for you. The ultimate responsibility for your finances lies with you.

- Provide legal advice: A financial coach cannot provide legal advice, such as how to set up a trust or establish a business entity. If you need legal advice, you should seek the services of an attorney.

- Sell products: A financial coach is not allowed to sell products or receive commissions from the sale of financial products. If a financial coach tries to sell you products, it may indicate a conflict of interest, and you should be wary of their services.

- Guarantee specific outcomes: A financial coach cannot guarantee specific outcomes or results. While they can provide guidance and support, the outcome of your financial situation ultimately depends on your actions and circumstances.

In summary, a financial coach can provide valuable guidance and support in helping you achieve your financial goals. However, it’s important to understand their limitations and know what they are not allowed to do. By knowing these limitations, you can make informed decisions about whether working with a financial coach is right for you.

What is the difference between a financial coach and a financial advisor?

When it comes to managing your finances, there are two professionals you may consider working with: a financial coach and a financial advisor. While their services may overlap in some areas, there are significant differences between the two. Here’s what you need to know:

- Services provided: A financial coach focuses on education and guidance in helping you set financial goals, develop a plan, and stay accountable to your objectives. On the other hand, a financial advisor provides specific financial advice and investment management services.

- Credentials and licensing: A financial coach does not require any specific licensing or credentials. However, many financial coaches hold certifications such as Certified Financial Education Instructor (CFEI) or Certified Financial Coach (CFC). In contrast, a financial advisor must hold specific licenses and credentials to provide investment advice, such as a Series 7 or 66 license.

- Compensation: A financial coach typically charges a flat fee or hourly rate for their services. Financial advisors, on the other hand, can receive commissions for selling financial products, as well as charge fees for their investment management services.

- Target audience: Financial coaches typically work with individuals who are looking to improve their overall financial wellness and may not have significant assets or investments. Financial advisors typically work with individuals who have more significant assets and investments and are looking for specific investment advice and management services.

- Investment advice: A financial coach is not licensed to provide investment advice. However, a financial advisor is licensed to provide investment advice and can help you make investment decisions based on your risk tolerance and financial objectives.

In summary, while both a financial coach and a financial advisor can provide valuable financial guidance and support, their services and qualifications differ significantly. Before deciding which professional to work with, it’s important to understand your financial goals and needs and determine which professional is best suited to help you achieve them.

Should I work with a financial coach?

Deciding whether to work with a financial coach can be a personal decision, and there are a few things to consider before making your choice. Here are some questions to ask yourself to help determine whether working with a financial coach is right for you:

- Do you have financial goals but struggle with achieving them? If you have specific financial goals but have been unable to achieve them, a financial coach can provide the guidance and support you need to create a plan and stay accountable.

- Do you need help creating a budget or managing debt? If you’re struggling with managing your finances, a financial coach can help you develop a budget and create a plan to pay off debt.

- Are you looking for someone to provide investment advice? If you’re looking for investment advice or need help managing your investments, a financial advisor may be a better fit for your needs.

- Do you have a limited budget for financial services? If you have a limited budget, working with a financial coach can be a more affordable option than working with a financial advisor, who may charge higher fees.

- Are you willing to put in the work to achieve your financial goals? While a financial coach can provide guidance and support, ultimately, achieving your financial goals will require effort and commitment on your part.

In summary, working with a financial coach can be beneficial if you have specific financial goals, need help managing your finances, or have a limited budget for financial services. However, if you’re looking for specific investment advice, a financial advisor may be a better fit for your needs. Ultimately, whether you choose to work with a financial coach depends on your individual circumstances and goals.

Is it worth getting a financial coach?

Deciding whether working with a financial coach is worth it is a personal decision that depends on your financial situation and goals. However, here are a few things to consider when determining if working with a financial coach is worth the investment:

- Cost: Working with a financial coach typically involves paying a fee, either hourly or a flat rate. Before deciding to work with a financial coach, you should consider the cost and whether it fits within your budget.

- Financial goals: If you have specific financial goals, such as paying off debt or saving for retirement, a financial coach can help you create a plan and stay accountable to those goals.

- Financial knowledge: If you have limited knowledge about personal finance, working with a financial coach can help you understand basic financial concepts and develop the skills you need to manage your finances effectively.

- Accountability: A financial coach can help you stay accountable to your financial goals by providing regular check-ins and support to help you stay on track.

- Return on investment: Working with a financial coach can help you achieve your financial goals more quickly and effectively, potentially resulting in a positive return on investment in terms of reduced debt, increased savings, or improved financial well-being.

In summary, working with a financial coach can be a valuable investment if you have specific financial goals, need help managing your finances, or have limited financial knowledge. However, before deciding to work with a financial coach, you should consider the cost and determine whether it fits within your budget. Ultimately, whether working with a financial coach is worth it depends on your individual circumstances and financial goals.

What are the benefits of working with a financial coach?

Working with a financial coach can provide numerous benefits to help you achieve your financial goals. Here are some of the benefits of working with a financial coach:

- Clarifying your financial goals: A financial coach can help you clarify your financial goals and develop a plan to achieve them. This can help you prioritize your spending and make more informed financial decisions.

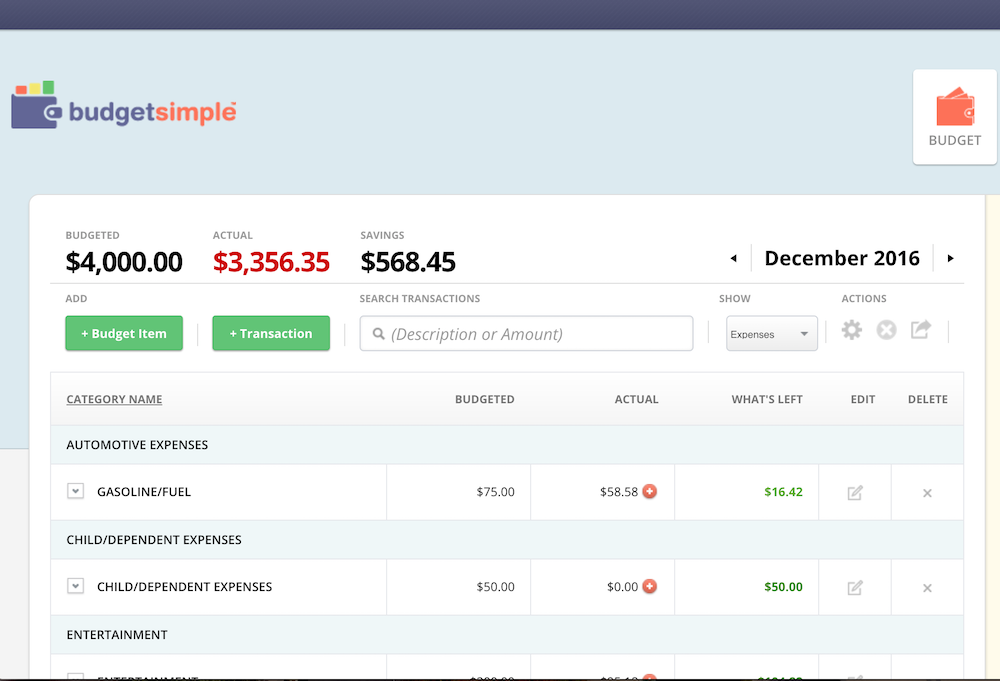

- Creating a budget: A financial coach can help you create a budget that works for your specific financial situation. This can help you manage your expenses and avoid overspending.

- Managing debt: If you’re struggling with debt, a financial coach can help you create a plan to pay it off more quickly and effectively.

- Developing financial skills: A financial coach can help you develop the financial skills you need to manage your finances effectively, such as understanding basic financial concepts, creating a financial plan, and investing.

- Accountability: A financial coach can provide accountability and support to help you stay on track with your financial goals. This can be especially helpful if you struggle with self-discipline when it comes to managing your finances.

- Improved financial well-being: Working with a financial coach can ultimately help you achieve greater financial well-being, which can lead to reduced stress and improved quality of life.

In summary, working with a financial coach can provide numerous benefits, including clarifying your financial goals, creating a budget, managing debt, developing financial skills, providing accountability, and improving your overall financial well-being. If you’re looking to improve your financial situation and achieve your goals, working with a financial coach may be worth considering.

Why should you hire a financial coach?

There are many reasons why you may choose to hire a financial coach. Here are some of the most common reasons:

- Clarify your financial goals: A financial coach can help you clarify your financial goals and develop a plan to achieve them. This can be especially helpful if you’re not sure where to start or are feeling overwhelmed.

- Manage debt: If you’re struggling with debt, a financial coach can help you create a plan to pay it off more quickly and effectively. They can also provide strategies for avoiding debt in the future.

- Create a budget: A financial coach can help you create a budget that works for your specific financial situation. This can help you manage your expenses and avoid overspending.

- Improve financial literacy: If you’re new to personal finance or are looking to improve your financial literacy, a financial coach can provide guidance and education on basic financial concepts and strategies.

- Prepare for major life changes: If you’re preparing for a major life change, such as buying a home, getting married, or having a child, a financial coach can provide guidance and support to help you make informed financial decisions.

- Provide accountability: A financial coach can provide accountability and support to help you stay on track with your financial goals. They can also help you stay motivated and focused, even during challenging times.

In summary, hiring a financial coach can help you achieve greater financial clarity, manage debt, create a budget, improve financial literacy, prepare for major life changes, and provide accountability and support. If you’re looking to improve your financial situation and achieve your goals, working with a financial coach may be a valuable investment.

What makes a good financial coach?

If you’re considering working with a financial coach, it’s important to find a coach who is a good fit for your needs and has the skills and experience to help you achieve your financial goals. Here are some qualities that make a good financial coach:

- Experience and qualifications: A good financial coach should have the necessary experience and qualifications to provide sound financial advice. Look for coaches who hold certifications such as Certified Financial Education Instructor (CFEI) or Certified Financial Coach (CFC).

- Communication skills: A good financial coach should be an effective communicator who can explain complex financial concepts in simple terms. They should also be able to listen actively to your concerns and questions.

- Empathy and understanding: A good financial coach should be empathetic and understanding of your unique financial situation. They should be able to provide guidance and support without judgment or criticism.

- Personalized approach: A good financial coach should be able to tailor their approach to your specific financial situation and goals. They should be able to provide personalized advice and strategies that work for you.

- Transparency: A good financial coach should be transparent about their fees and services. They should be upfront about their rates and any potential conflicts of interest.

- Positive track record: Look for a financial coach who has a positive track record of helping clients achieve their financial goals. Read reviews and testimonials from previous clients to get a sense of their experience working with the coach.

In summary, a good financial coach should have the necessary qualifications and experience, effective communication skills, empathy and understanding, a personalized approach, transparency, and a positive track record. By considering these qualities when choosing a financial coach, you can find a coach who is a good fit for your needs and can help you achieve your financial goals.

How much should a financial coach cost?

The cost of working with a financial coach can vary depending on the coach’s experience and the services they offer. Here are some common pricing structures for financial coaching:

- Hourly rate: Some financial coaches charge an hourly rate, which can range from $50 to $300 per hour. The hourly rate may be lower for newer coaches and higher for more experienced coaches.

- Flat fee: Some financial coaches charge a flat fee for their services, which may range from $500 to $5,000. The flat fee may cover a specific number of coaching sessions or a specific service, such as creating a financial plan.

- Percentage of assets: Some financial coaches charge a percentage of assets under management (AUM) as their fee. This fee structure is more common for financial advisors who also provide investment management services. The percentage of AUM may range from 0.5% to 2% or more.

- Performance-based: Some financial coaches may offer a performance-based fee structure, which means their fee is based on your progress toward achieving your financial goals. This fee structure is less common and may be more expensive than other fee structures.

When considering the cost of working with a financial coach, it’s important to factor in the potential return on investment. By working with a financial coach, you may be able to achieve your financial goals more quickly and effectively, which can lead to improved financial well-being and reduced stress.

In summary, the cost of working with a financial coach can vary depending on the coach’s experience and the services they offer. It’s important to consider the potential return on investment and factor in the cost when determining whether working with a financial coach is worth it for your specific financial situation and goals.

What skills do you need to be a financial coach?

Being a financial coach requires a range of skills to effectively help clients manage their finances and achieve their financial goals. Here are some skills that are important for a financial coach:

- Knowledge of personal finance: A financial coach should have a strong understanding of personal finance concepts such as budgeting, saving, investing, and debt management.

- Communication skills: A financial coach should be an effective communicator who can explain complex financial concepts in simple terms. They should also be able to listen actively to clients and understand their unique financial situations.

- Coaching skills: A financial coach should have coaching skills such as active listening, asking open-ended questions, and providing feedback and support.

- Empathy and understanding: A financial coach should be empathetic and understanding of clients’ financial situations. They should be able to provide guidance and support without judgment or criticism.

- Analytical skills: A financial coach should be able to analyze clients’ financial situations and develop strategies that work for their specific needs and goals.

- Business skills: A financial coach should have business skills such as marketing, networking, and managing their own finances and business.

- Professionalism and ethics: A financial coach should adhere to professional standards and ethics, such as providing unbiased advice and avoiding conflicts of interest.

In summary, being a financial coach requires a range of skills including knowledge of personal finance, communication skills, coaching skills, empathy and understanding, analytical skills, business skills, and professionalism and ethics. By possessing these skills, a financial coach can effectively help clients manage their finances and achieve their financial goals.

What are the responsibilities of a financial coach?

The responsibilities of a financial coach can vary depending on the coach’s experience, qualifications, and the services they offer. Here are some common responsibilities of a financial coach:

- Developing a financial plan: A financial coach should work with clients to develop a comprehensive financial plan that takes into account their goals, income, expenses, debts, and assets.

- Providing education and guidance: A financial coach should provide education and guidance on personal finance topics such as budgeting, saving, investing, and debt management.

- Setting and tracking financial goals: A financial coach should help clients set specific financial goals and develop a plan to achieve them. They should also help clients track their progress and make adjustments as needed.

- Offering accountability and support: A financial coach should provide accountability and support to help clients stay on track with their financial goals. They should also offer encouragement and motivation when clients face challenges or setbacks.

- Providing unbiased advice: A financial coach should provide unbiased advice that is in the best interest of the client. They should avoid conflicts of interest and disclose any potential conflicts.

- Adhering to professional standards and ethics: A financial coach should adhere to professional standards and ethics, such as providing confidential and respectful services, and avoiding discrimination or bias.

In summary, a financial coach has a range of responsibilities that include developing a financial plan, providing education and guidance, setting and tracking financial goals, offering accountability and support, providing unbiased advice, and adhering to professional standards and ethics. By fulfilling these responsibilities, a financial coach can help clients improve their financial well-being and achieve their financial goals.

What are the components of financial coaching?

Financial coaching involves a range of components that work together to help clients manage their finances effectively and achieve their financial goals. Here are some common components of financial coaching:

- Financial planning: Financial coaching typically involves developing a comprehensive financial plan that takes into account the client’s income, expenses, debts, assets, and financial goals. This plan serves as a roadmap for achieving the client’s financial objectives.

- Education and guidance: Financial coaching includes providing education and guidance on personal finance topics such as budgeting, saving, investing, and debt management. This helps clients build their financial literacy and confidence in managing their finances.

- Goal setting and tracking: Financial coaching involves setting specific financial goals and developing a plan to achieve them. A financial coach helps clients track their progress and adjust their plan as needed to achieve their objectives.

- Accountability and support: Financial coaching provides accountability and support to help clients stay on track with their financial goals. A financial coach offers encouragement, motivation, and guidance to help clients overcome obstacles and stay focused on their objectives.

- Review and feedback: Financial coaching involves regular review and feedback on the client’s financial situation and progress. This helps clients identify areas where they are doing well and areas where they need to improve.

- Behavioral change: Financial coaching recognizes that behavior change is a key component of managing finances effectively. A financial coach helps clients identify and change financial habits that are hindering their progress toward their goals.

In summary, financial coaching involves a range of components including financial planning, education and guidance, goal setting and tracking, accountability and support, review and feedback, and behavioral change. By addressing these components, financial coaching can help clients manage their finances effectively and achieve their financial goals.