Paying off debt can be a huge accomplishment that brings a great sense of relief and freedom. However, many people find themselves falling back into debt shortly after they’ve paid it off. This is a frustrating and demoralizing situation that can make it difficult to achieve financial stability. The problem of falling back into debt is all too common, but it’s not inevitable. With the right strategies and mindset, it’s possible to avoid this problem and maintain a debt-free lifestyle.

One of the main reasons people fall back into debt is that they don’t make lasting changes to their spending habits and financial behaviors. Paying off debt can be a difficult process that requires sacrifice and dedication, but it’s often seen as a temporary challenge. Once the debt is gone, it’s easy to slip back into old habits and spending patterns that can lead to new debt. In addition, unexpected expenses, job loss, and other life events can quickly erode progress and push someone back into debt.

Avoiding the problem of falling back into debt is crucial for long-term financial stability and success. It requires a commitment to making lasting changes to your financial habits and a willingness to adapt to life’s challenges. By developing a plan for maintaining your debt-free status, you can enjoy the peace of mind and financial security that come with being debt-free. In the following sections, we’ll discuss some strategies for avoiding the pitfalls of falling back into debt after you’ve paid it off.

Understand Why You Got Into Debt in the First Place

Reflecting on Your Debt

To avoid falling back into debt, it’s essential to reflect on why you got into debt in the first place. Did you overspend on credit cards or take out too many loans? Did unexpected expenses arise, such as medical bills or car repairs? Did a loss of income or job loss make it difficult to keep up with bills? Understanding the root causes of your debt can help you avoid repeating the same mistakes.

Identifying Behaviors, Habits, or Circumstances

Once you understand why you got into debt, it’s important to identify any behaviors, habits, or circumstances that contributed to the problem. This might include overspending, relying too much on credit, failing to save for emergencies, or not having a budget in place. Perhaps you simply didn’t have the financial knowledge or resources to manage your money effectively. Take a close look at your finances and be honest with yourself about what went wrong.

Addressing the Factors

To prevent falling back into debt, you’ll need to address the factors that led to your initial debt. This might involve developing better spending habits, such as sticking to a budget and avoiding unnecessary purchases. You might need to work on increasing your income or finding ways to reduce expenses. Building an emergency fund and prioritizing savings can also help you avoid the need for credit or loans in the future. Consider seeking financial education or guidance if you need help developing a plan.

By reflecting on the reasons why you got into debt, identifying any problematic behaviors or habits, and addressing those factors, you can avoid falling back into debt. The key is to stay committed to making lasting changes and to be proactive in managing your finances. With the right approach, you can maintain a debt-free lifestyle and enjoy greater financial security.

Continue to Live Within Your Means

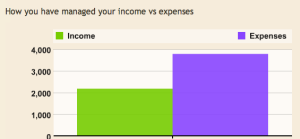

The Importance of Maintaining a Budget

Maintaining a budget is crucial for avoiding falling back into debt. A budget helps you track your income and expenses, so you know where your money is going. It also helps you plan for the future and avoid overspending. Once you’ve paid off your debt, continue to live within your means and maintain a budget to stay on track.

Ways to Cut Back on Expenses

To stay within your budget, you may need to cut back on expenses. This can be difficult, but it’s necessary to avoid falling back into debt. Look for areas where you can reduce spending, such as dining out less often or shopping for groceries on sale. Consider ways to lower your bills, such as negotiating with service providers or switching to a lower-cost plan. You might also want to consider downsizing or finding ways to reduce housing costs if necessary.

Tips for Avoiding Unnecessary Spending

To avoid unnecessary spending, try to distinguish between wants and needs. Focus on the things that are truly important and find ways to cut back on non-essential purchases. Before making a purchase, ask yourself if it’s something you really need or if it’s something that can wait. Try to avoid impulse buys and stick to your budget as much as possible. If you do make a purchase, look for deals and coupons to save money.

By maintaining a budget, cutting back on expenses, and avoiding unnecessary spending, you can stay within your means and avoid falling back into debt. It takes discipline and planning, but it’s worth the effort to maintain a debt-free lifestyle. Remember to focus on your goals and prioritize your spending accordingly. With the right approach, you can enjoy financial stability and freedom.

Build an Emergency Fund

The Importance of Having an Emergency Fund

One of the best ways to avoid falling back into debt is to have an emergency fund. An emergency fund is a stash of money that you can use to cover unexpected expenses, such as medical bills or car repairs. Without an emergency fund, you may have to rely on credit cards or loans to cover these costs, which can quickly lead to debt. By having an emergency fund, you can avoid these financial pitfalls and stay on track with your debt-free goals.

Setting Up and Funding an Emergency Fund

To set up an emergency fund, start by determining how much you need to save. Ideally, your emergency fund should cover three to six months’ worth of living expenses. Once you have this figure, open a separate savings account and begin setting aside money each month. You can do this by automating transfers from your checking account to your emergency fund. Be consistent with your contributions and avoid dipping into the fund for non-emergency expenses.

Scenarios in Which an Emergency Fund Can be Useful

An emergency fund can be useful in a variety of scenarios, such as unexpected medical bills, car repairs, or job loss. It can also come in handy for unexpected home repairs or appliance replacement. By having an emergency fund, you can avoid falling back into debt when these situations arise. It can also give you peace of mind knowing that you’re prepared for the unexpected.

Building an emergency fund is an important step in avoiding falling back into debt. It may take time and effort to save up the necessary funds, but it’s worth it for the financial security and peace of mind it provides. By setting up and funding an emergency fund, you can avoid the need for credit or loans in unexpected situations and stay on track with your debt-free goals.

Avoid Credit Card Debt

The Dangers of Credit Card Debt

Credit card debt can be a slippery slope that can quickly lead to falling back into debt. High interest rates, fees, and penalties can quickly accumulate, making it difficult to pay off the debt. Additionally, credit card debt can negatively impact your credit score, which can make it harder to obtain loans or credit in the future. To avoid the dangers of credit card debt, it’s important to use credit cards responsibly.

Tips for Using Credit Cards Responsibly

To use credit cards responsibly, only charge what you can afford to pay off each month. Don’t carry a balance on your credit cards, as this will only result in high interest charges. Always make payments on time and in full to avoid fees and penalties. Consider using credit cards for specific purposes, such as travel or online purchases, and avoid using them for everyday expenses. Be mindful of your credit limit and don’t exceed it.

Paying Off Credit Card Debt in a Timely Manner

If you already have credit card debt, it’s important to pay it off in a timely manner to avoid falling back into debt. Start by prioritizing your payments on credit cards with the highest interest rates. Consider consolidating your debt with a balance transfer credit card or personal loan with a lower interest rate. Avoid using your credit cards while you’re paying off your debt. Make a budget and stick to it to ensure you’re making consistent payments.

To avoid falling back into debt, it’s important to use credit cards responsibly and pay off credit card debt in a timely manner. By avoiding credit card debt and paying off existing debt, you can maintain a debt-free lifestyle and enjoy greater financial security. Remember to be mindful of your spending habits and prioritize your debt payments to stay on track. With the right approach, you can enjoy financial freedom and peace of mind.

Seek Professional Help

Why Seek Professional Help

If you’re struggling to manage your finances or stay out of debt, seeking professional help can be a great option. A financial advisor or credit counselor can provide expert guidance and advice tailored to your specific situation. They can help you develop a plan for managing your money and avoiding debt. They can also provide support and accountability to help you stay on track.

Benefits of Professional Assistance

One of the main benefits of seeking professional assistance is the expertise and knowledge they can offer. A financial advisor or credit counselor can help you develop a comprehensive financial plan that takes into account your goals, income, expenses, and debt. They can help you identify problem areas and provide solutions to help you avoid falling back into debt. They can also help you navigate complex financial situations, such as investing, retirement planning, or dealing with creditors.

Resources for Finding Help

If you’re interested in seeking professional help, there are many resources available. Consider reaching out to a local credit counseling agency or financial planner. You can also search for certified financial planners or credit counselors online. Look for professionals with good reviews and certifications from reputable organizations, such as the National Foundation for Credit Counseling or the Financial Planning Association.

Seeking professional help can be a valuable tool for avoiding falling back into debt. A financial advisor or credit counselor can provide the expertise and guidance you need to manage your finances and stay on track. Remember that there is no shame in asking for help, and seeking professional assistance can be a positive step toward achieving your financial goals. With the right resources and support, you can enjoy financial stability and freedom.

Conclusion

Avoiding falling back into debt after paying it off can be a challenging task, but it’s not impossible. In this article, we’ve discussed several key strategies for staying debt-free, including understanding why you got into debt in the first place, living within your means, building an emergency fund, avoiding credit card debt, and seeking professional help. By following these tips, you can stay on track with your financial goals and avoid the negative consequences of falling back into debt.

Take Action to Avoid Falling Back into Debt

The key to avoiding falling back into debt is taking action. Start by reflecting on your financial situation and identifying areas where you can improve. Develop a budget and stick to it, avoiding unnecessary spending and focusing on your financial goals. Build an emergency fund to prepare for unexpected expenses, and avoid credit card debt by using credit cards responsibly and paying off existing debt. Don’t be afraid to seek professional help if you need it, and remember that there are many resources available to support you.

Final Thoughts

Falling back into debt can be a frustrating and demoralizing situation, but with the right approach, it’s possible to avoid this problem. Stay committed to your financial goals, take action to manage your money responsibly, and seek help when you need it. By following these strategies, you can maintain a debt-free lifestyle and enjoy greater financial stability and freedom. Remember, it’s never too late to take control of your finances and achieve your goals.