I created BudgetSimple around a budgeting philosophy my wife and I had used in Excel. Something I’ve realized over the years is that there is basically no one right way to budget, so some people come to BudgetSimple confused about how it works or why it doesn’t work a way they are used to. Hopefully walking through how I use it will help you figure it out for your finances!

First, BudgetSimple is monthly. This is the first thing that trips people up because not everyone gets paid monthly, and many people think of budgeting as allocating individual dollars of your paycheck. While it is that, it’s also not a great idea to budget that way, since if you get a new job or your pay schedule changes, you have to relearn how to do your finances.

So why monthly? Well, first most large regular expenses like rent or mortgages, or car payments are due monthly. Second, months are standard periods of time that let you easily compare one to another. If you do bi-weekly budgeting, it may be very hard to compare Week 12 of the year to Week 32, but April to October is easier.

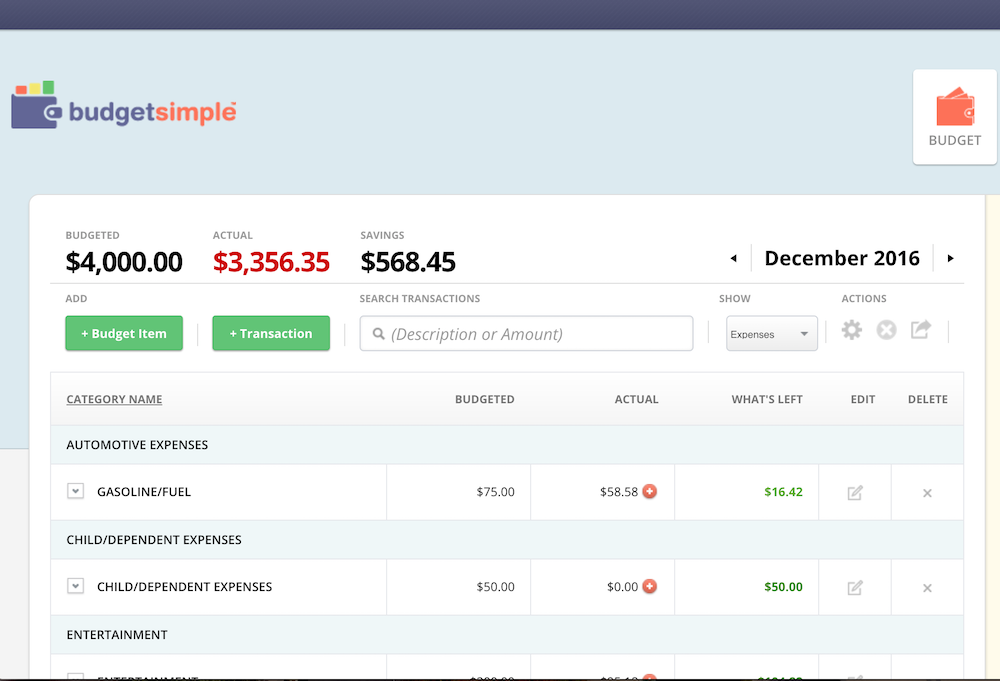

Ok, so enough about that, how do I actually use BudgetSimple? First, I use BudgetSimple Plus, so all of my transactions automatically get downloaded and categorized. If you don’t have Plus, that’s ok, you just enter the transactions yourself. Even though BudgetSimple does a pretty good job of categorizing (and it learns over time to get better), I still always go to the “Transactions” view, and look at all of the “yellow” transactions that have been downloaded since my last visit.

This helps me see if any need to be recategorized, but it’s also really important to keep an eye on your finances, in case you are spending more than you want, or as I recently noticed, someone has used your card fraudulently! Automatic downloading doesn’t mean finances on cruise control, I strongly encourage all users to login every day and look at all spending.

After I am happy with my categorization, I look how I’m doing compared to my budget goals.

Here’s some common problems people encounter, and how I handle them:

What About Expenses Like Insurance Which Are Due Once Every 6 Months?

For these, I create a Savings Fund called “Insurance”, under the Tools area. I take the total number I need for 6 months, divide by 6, and make a corresponding budget category for that amount, so I’m saving 1/6th of the cost of my insurance every month in my budget.

![]()

When the actual insurance bill comes due, I log it as an “Unbudgeted” Insurance transaction, and then manually create an offsetting debit from my Insurance fund (so I track a -$600 expense to cancel it out).

What About a Surplus or Deficit?

Most likely you won’t perfectly spend everything in a month. There are two ways I handle this. If I have a surplus (I spent less than a planned), typically I’ll just take that amount of money and add it to savings. I might also choose to carry over that surplus to the next month, so if I spent $150 of $200 planned for dining out, maybe I’ll plan $250 of dining out next month! If there is a deficit, I do one of those two things as well. Either I put less into savings, or I carry the deficit over to the next month. BudgetSimple has a feature that automatically allows you to choose one method or the other.

What If I Get Paid On Commission Or Irregularly?

I’ve been there, I’ve done and sometimes still do contracting work, or I’ll sell some stuff on eBay, or for whatever reason my pay is different. The nice thing with BudgetSimple is every month is a distinct budget. So create a pessimistic (low) plan of what you believe you’ll earn that month, and the next month it can be different.

What If I Get Paid Bi-Weekly?

Create your monthly budget, and budget around the income of two paychecks. There will be one/two months a year where you’ll get three paychecks, simply treat that third paycheck as a bonus! This is a surprisingly nice way to hack your savings growth.