Since the question comes up often enough, I thought it was worth comparing BudgetSimple to Mint, how they are different and how they can be used together.

Getting Started

First, it’s important to understand that even though Mint branded itself as a budgeting tool, it’s primary features are not budgeting. Mint is a tool for cash flow, so you can use it as one stop shop to see where your money is going, but don’t expect your finances to improve. Mint allows you to link your bank accounts for free (they make money by selling your data and providing you offers, primarily for credit cards). Mint will then show you where your money has gone. This works great if all of your bank accounts are supported by Mint. Assuming they are, Mint makes it pretty simple to link them all up and at the end you’ll have an idea where your money has been going.

BudgetSimple has two options for getting started. Just like Mint you can connect your bank account and quickly and easily get started. Unlike Mint, BudgetSimple does charge for this feature, we do so because you are our customer, not advertisers. By paying you’ll get automated unbiased tips, and your data will remain yours.  We also support banks around the world including UK, France, Australia and New Zealand. If your bank is not supported, or you are not comfortable linking your bank, you can still use BudgetSimple. Our manual option allows you to enter your income and expenses as they incur, which gives you super visibility into what’s happening.

We also support banks around the world including UK, France, Australia and New Zealand. If your bank is not supported, or you are not comfortable linking your bank, you can still use BudgetSimple. Our manual option allows you to enter your income and expenses as they incur, which gives you super visibility into what’s happening.

Mint Bottom Line: Free, but if your bank is not supported, you essentially can’t use Mint. This means you, everyone outside of the USA and Canada. Also get ready for lots of emails selling you more credit.

BudgetSimple Bottom Line: Anyone can use BudgetSimple, we support international banks. We do charge money to link your bank account (although we offer an unconditional money back guarantee, so if it’s not helping you just get your money back, win-win!).

Creating a Budget

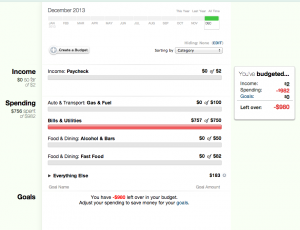

Mint does have a budgeting feature, and it allows you to simply set the amount of money you’d like to spend on a category in a given month, and will monitor your progress against that spending. This budget assumes you know how much income you make, and doesn’t really do any more then described. If you have unbudgeted expenses it will just pile that into an “Everything Else” category. If you go over or under a budget, there is no option to carry over the difference or reallocate it.

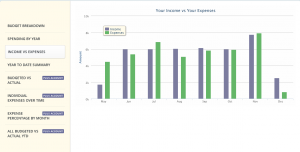

BudgetSimple is designed for budgeting, we show you clearly where you are meeting your goals and where you are not. We let you have different budgets each month, carry over the difference and help you reallocate. When you exceed your budget, we provide tips to help you understand how to fix it. Our goal is to create good financial practices that help you forever. If you link your bank account, we’ll even recommend a budget to start based on your current habits.

Mint Bottom Line: Allows you to see where your spending goes in relation to your plans, but the budget is not flexible, and encourages a cash flow approach to finance, which leads to paycheck-to-paycheck spending

BudgetSimple Bottom Line: We do budgets best.  In fact, you HAVE to have a budget to use BudgetSimple, an we help you with the process. For those that want to focus only on cash-flow, you’re out of luck.

In fact, you HAVE to have a budget to use BudgetSimple, an we help you with the process. For those that want to focus only on cash-flow, you’re out of luck.

Big Picture

The biggest question is why should you use BudgetSimple, which charges for the same thing that Mint gives for free. The answer is that you often have to spend money to make money, and this is one of those cases. The money we receive from subscription fees goes directly to improving the product. Because you are the customer, our focus is improving your experience. With Mint, the credit card companies are the customer, and their goal is to improve their ability to get more leads. Because of this, you probably won’t see the same difference in your finances that we’ve seen over the years with BudgetSimple.

BudgetSimple gets you started on financial best practices that have been working for people in the know for years. Just read some of the testimonials we’ve received from users (who have used both the free and paid versions). We aim to provide you with unbiased advice to help you with your finances. Although we recommend products to you occasionally, we recommend things regardless of whether they pay us a cut (although sometimes they do). With Mint if you want help you can submit a web form and maybe get some generic assistance. You can email the CEO of BudgetSimple personally, and I’ll be glad to help you (we also have others who are happy to help!).