By far the most common question I get for people signing up to BudgetSimple is “How do I budget weekly with your system? I get paid weekly (or bi-weekly, semi-monthly, on commission), and your system does monthly budgeting.”

My response is always similar, I’ve very rarely been paid monthly in my life, and yet this is the budgeting system I’ve used, and the reason it works is because budgeting and cash flow are different things entirely.

Businesses get paid completely irregularly. The way they manage their finances is with a solid budget. If we treat your household like a business, you can use the same tricks for success.

What is Cash Flow?

Cash flow is figuring out where you get the actual cash to pay a bill. You have to worry about how to get income and how to allocate that to your expenses. Budgeting helps with this greatly, but it’s best to separate the cash flow from budgeting. Budgeting is a plan for your money, Cash Flow is what you see in your check register.

Why is this? First, figuring out how to allocate money from each paycheck results in paycheck-to-paycheck living. The more you can separate a paycheck from your financial plan, the more likely you’ll be able to handle your situation. Paycheck to paycheck living really trips people up when there are infrequent expenses like a quarterly water bill, or insurance bill every 6 months, or a surprise car repair. If you are planning paycheck to paycheck, these bills will always be a huge surprise.

Budgeting

Instead of trying to allocate dollars from specific paychecks, we recommend you look at your income/spending more holistically, specifically at a monthly level. The reason we pick monthly is it’s much easier to compare your spending over time. If we did weekly budgeting, the week your rent is due would always be over budget, and the weeks no bills are due would always be under budget.

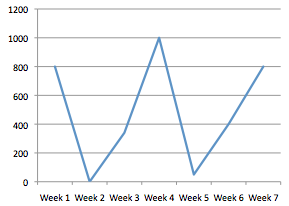

Let’s compare a chart of 8 weeks spending:

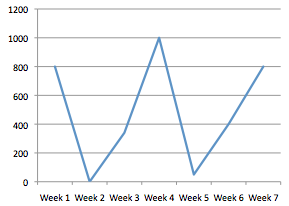

Versus a chart of 8 months spending:

You can see it’s much easier to tell from the monthly chart how your spending has increased of decreased over time. In the same way, we can much more easily compare one month to the next, where one week to the next is almost never a good comparison.

Ok But How?

So your next question is, how do I use a monthly budget if I get paid weekly? The simplest answer is that you multiply your average weekly pay by 52 (the number of weeks in the year), and then divide by 12 (the number of months in the year).

Example: $500 per week = $26000 per year / 12 = 2166.67 per month

Now some months you’ll make more then that, and some months you’ll make less (because there are more or less Fridays in a given month), however, on average you should earn somewhere around this amount. The key is if you make a conservative spending plan, all your bills should be able to be paid within this monthly budget. The months that you make more will build your savings, where the months that you make less will require savings.

However, you still may find yourself “short”. Unfortunately there is one drawback to this method, which is you’ll NEED some savings to float between paychecks at times. If you have no savings, this is going to be trickier. I still recommend plotting out a budget plan, because just putting a plan in writing often helps you achieve your goal.

Let us know on Facebook or Twitter if you have specific scenarios you need help with!