Nothing is more important to your financial future than being debt-free. Credit card debt not only means that you’re spending money that you don’t have, but you’re also paying EXTRA in interest! I’ve been down that road and back, and while it was incredibly stressful and unpleasant, I’m so happy to report that I’ve been (almost) debt-free for about a month now! I say almost because I don’t include necessary student loans under that umbrella; I’m talking strictly credit cards. Managing my card has been a struggle since college, and I think I’ve finally gotten the hang of spending wisely and within my means.

First, a little background history. I got my first credit card in college because I was told that it would be a great way to build my credit; spend a little, pay a little, raise your credit scores. One credit card turned into a handful of cards, mostly from stores I shopped at frequently. Since I was only working a minimum wage job, I used these to pay for things I “needed,” and I always promised myself that I’d pay them off when my check came in every other week. I seldom kept those promises, and my debt grew. Even a small amount was suffocating to me, and I was at least smart enough to recognize that and stop using store cards after my initial fears set in. For some reason though, I couldn’t let go of that first card I got. It gave me the freedom to go out on weekends with my roommates, give lavish gifts to my closest friends, and furnish my first apartment. By the time I graduated, I had accrued a few thousand dollars in credit card debt. My problem became very apparent when I had to make my first payment on my student loans, and I was more overwhelmed than I’ve ever felt. I knew I had to make a change.

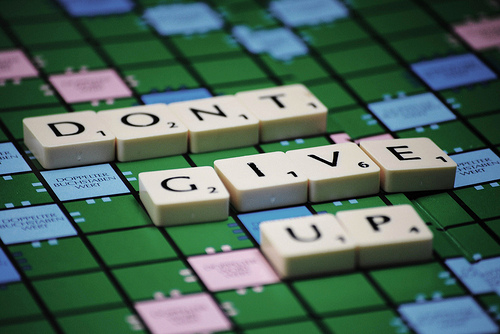

How I got it under control. I think the most important factor that I changed was learning to say “no.” No to going out all of the time, no to new clothes I didn’t need, no to spending extra on anything I didn’t absolutely love or need to have. I started to really think about my purchases and how necessary they were. Earlier on, I had a justification for everything I bought, no matter how ridiculous, and I was starting to see the error of my ways. I created a budget to help me figure out how much money I needed every month to pay my bills, and this allowed me to see how much was left over to contribute to my credit card balance. For a whole year, I threw every extra penny I had at that bill, and I was extremely careful with my spending. While it wasn’t fun to feel like I was missing out sometimes, it was worth it to see that number slowly start to come down. Last month, after taking on a few extra side jobs, I was able to bring that number down to $0, and I’ve never felt more proud of myself.

So what now? Now that I don’t need to contribute everything I possibly can to my debt, I find myself with more money each month, which is a wonderful feeling! In addition to contributing extra to my savings, I’ve started to create a bit of a “splurge” fund for things that I might not need, but would like to have or do. In a way, that fund has replaced my credit card, except I don’t feel guilty using it because that’s what it was set up for, and my budget tells me that I can afford it. Now that I’ve found something that works for me, I don’t plan on going back to my old habits. That nice round 0 is just too pretty to look at! If I can do it, I know it’s possible for anyone to get rid of their debt with a little discipline and determination.

Do you have any tips or advice for getting rid of credit card debt? Have you ever found yourself in a similar situation? Share your stories with us!