Sometimes our budgets don’t go EXACTLY as planned. Ok, actually pretty much never do they go exactly as planned. So what do you do when you budget $600 for Groceries, but only spend $400? Or worse, you budget $600 and spend $700?

That’s where carryover comes into play. With BudgetSimple, you have a couple of options when you start a new month. You can either just ignore any overages and underages, and keep the same budget for the next month, or you can carry over the surplus or deficit into the next month.

Why would you want to do this? Well, let’s say you have $1,000 to budget each month. If you keep spending over $1,000 you’ll go into debt. Now, it’s inevitable that occasionally you will need to overspend your budget, so to avoid debt or eating into savings, the only thing you can do it make up the deficit of one month in another month.

For example, you budget $1,000 and spend $1,200. The next month, if you only spend $800, you’ll have made up for the previous month, and for the year still be on budget. Vice versa, if you only spent $800 the first month, you could spend $1,200 the next month.

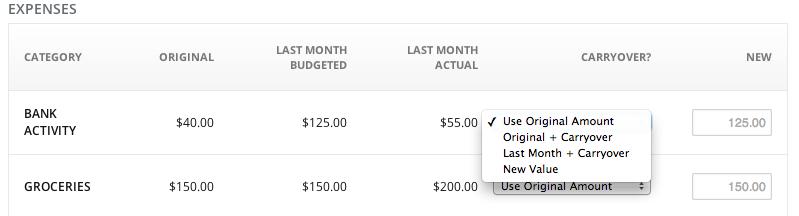

In BudgetSimple, we give you several options when a new month starts:

The first option Use Original Amount is pretty straight forward. If you simply want to keep the budget the same as you originally set it, use this option. Things like Rent that are static will almost always use this.

The next option is to use the Original + Carryover. What this means is we’ll take the difference of your budgeted amount last month and your spending last month, and add it to the original amount you had budgeted.

Last Month + Carryover will use the amount you budgeted last month plus the difference of last month’s budgeted amount and actual spending.

Confused what the difference between Original and Last Month is? The original amount is the amount you first set this budget amount to, called the “Base Amount”. For example, you may want to spend $500 on groceries every month. This can become out of whack once you start using the Carryover function. For example:

Month 1: $500 budgeted, $600 spent

Month 2, you decide to use the Carryover feature: $400 budgeted, $600 spent

Month 3, ok if you carried over from the previous month you’d now be down to $200 a month for your grocery budget! That’s probably unlikely as you’ve never been able to even do your original goal of $500. In this case you might just want to call it a loss and shoot for your ORIGINAL $500 budget, or just apply the carryover to the original, instead of last month’s.

So when you carryover, think about how you want to carry over the surplus or deficit from the last month, to make your next month’s budget reasonable. If you change the drop down and see the effect on your new budget item, and nothing will be saved until you click the “Create” button.