I live on a pretty tight budget, so I’m always looking for creative new ways to save money without much to spare. This could be a great plan to follow for those who are new to saving, or for others, like me, that don’t have a huge income to work with. I’ve been setting aside larger portions of my usual monthly savings for special events I have coming up, but I was thinking this could be the perfect way to save just a little bit extra strictly for our new house, which we’re hoping to purchase next spring.

savings

5 Things That Will Bust Your Budget

Even if we have the best-laid plans set out to stay on track, life occasionally throws us a curve. The smartest way to be prepared for financial emergencies is to have a back-up fund for whatever unexpectedly comes your way. How do you know what you should prepare for? Well, you don’t, but these are some of the most common wrenches that get thrown into the mix:

Have Your Cake and Eat It, Too

I’ve found that one of the most confusing things about saving money is figuring out what in the world you actually need to save for. Everyone pushes this idea that you need to have a back-up stash of cash in your possession in case anything unexpected should pop up – even as kids, most people have piggy banks to save up spare change for a rainy day. But what about things like life events (weddings, having a baby), large purchases (buying a house or car), or vacations?

I Just Won A Thousand Dollars!

… well, at least that’s how I feel every time I see unallocated money in my bank account. Sometimes after I’ve paid all of my necessary bills, estimated what I’ll need for my variable expenses, and put some money aside in my savings account, I’ll still have some cash left, and it can feel a bit like hitting the lottery (a very small one, at that). So what do you do with that extra $25 or $50 you still have just hanging out in your checking account?

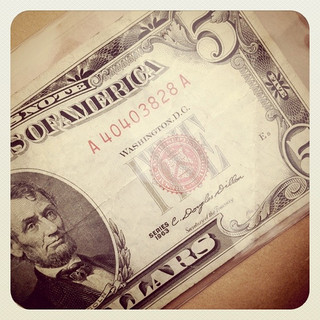

$5 Savings Challenge

One of the simplest ways to save money is to collect your spare change. It seems kind of trivial at first, small potatoes in the grand scheme of things, but it can add up quickly. I have fond memories of racing to my uncle’s couch in his “man cave” to search for loose change to add to my piggy bank (which I still do, 20 years later). Recently, I’ve seen a new idea pop up all over the internet that expedites the saving process a bit without sacrificing much: the $5 Savings Challenge.

Food for Thought

Many people have a love/hate relationship with grocery shopping – my guess is that most people fall into the latter category, myself included. It can be time-consuming and frustrating, but we all need to do it – food is the most basic necessity of life, and we can’t forget to allocate room for it in our monthly budgets! Check out the following suggestions for some of the easiest and most common ways to cut down on your grocery bill.

Houses, Cars, and Money – Oh My!

Like many others in their 20’s (and even 30’s), I’m feeling the pressures of adulthood – college is over, a career has been obtained, and it’s time to be a real-life grown-up! Friends are getting married, buying houses, and starting families. As excited as I am to join this elusive club of workaholics and soccer moms, it’s hard to not be at least a little intimidated by all of the dollar signs associated with some of those things. However, for the first time in my life, I don’t feel like these things are so far out of reach. With a little planning, larger purchases are most definitely attainable, and with a new car and a house on my horizon, I’ll spend the next year proving just that! So where do I even start?

Should I Put Money Into Savings or Pay Off Credit Cards?

So the new year has started, and you want to get your finances together. A question I get often is, should I build some savings first, or pay off my credit cards first.