When I was 23, my biggest worry was that I wouldn’t have enough money in my Checking account. But once you start following the BudgetSimple Financial Game Plan you are going to have a different problem. TOO much money in your checking and savings account.

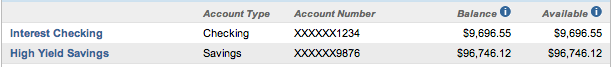

If you’ve been budgeting well, and being a good saver, your bank balances are going to get quite healthy like the image above. Let’s suppose my monthly expenses are $4,000 per month, how much money am I earning here?

Well, if you have been following our game plan, you should have both an interest bearing checking account, and also a high yield savings account. However, even the best interest checking accounts are well under 1% interest, and the very best savings accounts are at 1% at best.

So if I leave that $96,700 in my Savings account for a year, I’ll generate $967 at best. Not bad free money right? But what if we could earn more interest?

| 2% | $1,934 |

| 3% | $2,902 |

| 4% | $3,869 |

| 5% | $4,837 |

| 6% | $5,804 |

An extra $5,000 a year, without doing any more work besides moving money around? Yes, it’s true. More reward means more risk, but I’ve found a consistent 6% return over the years. Some years you get 10%, others you may lose money, but in the end it will almost always average out to above what you are receiving in your savings account.

If you’ve been waiting around to do something with your savings, wait no further. While the risk of losing your money is very real, in reality today you are losing money to inflation every day. I don’t recommend anyone start trading stocks on their own, but you also don’t need to go to a fancy financial advisor. Simply go to one of the sites below and open an ETF or No Load Mutual Fund account (I’ll talk about specifics in a later post).

So how much should you be keeping in each account? My recommendation is this:

| Checking | 1 Month of Expenses |

| Savings | 3 Months of Expenses |

| Semi-Liquid Investment | 3 Months of Expenses |

What do I mean by Semi-Liquid Investment? I mean something you can take money out of immediately without penalty, but it’s not an ideal instrument for constantly moving money in and out. Some non-liquid investments are CDs, certain bonds, debt, etc… On the other hand ETFs and Mutual Funds can generally be withdrawn from without a penalty.

Beyond that, you should be ok spreading investments as you please, as long as you are always diversifying. It’s ok to invest in something high risk such as Lending Club, as long as it’s offset by many other investments. You’ll lose some, you’ll win some, but in the end you’ll usually come out ahead.

I shouldn’t need to mention this, but will anyway. Past results are not indicative of future returns, and nothing is guaranteed. That said, don’t let fear force you to keep huge amounts in savings.