If you’re in debt right now, it’s nothing to be embarrassed of.

Over half of all Americans have some revolving credit debt (i.e. not counting mortgages and student loans), and 10% have 10k or more in credit card debt. Unfortunately, it’s actually much more expensive to be a low income member of our society then a high income one. Ironically, people with lots of money get free checking, refunded ATM fees, better interest rates. If you are working class individual, all of these things cost considerably more, which makes it very hard to get ahead of the eight ball. That said, there are some things that will really compound the problem and should be avoided at all costs.

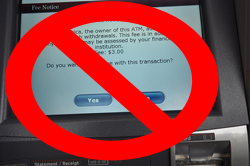

- ATM Fees – These can run as much as $5-7. Look for a bank or credit union that refunds ATM fees. Otherwise, try to find a bank that has lots of ATMs near you. Take cash out before you travel. There’s really no excuse for paying ATM Fees unless it’s really an emergency.

- Late Fees – Do everything possible to avoid late fees. If you have a bad memory, setup an automated reminder on Google Calendar, setup a recurring expense in BudgetSimple. If you are short of money, it’s probably better to borrow some money from someone then get hit with a late fee. Some types of credit will also goose your interest rate if you are ever late, and this can also have a negative effect on your credit.

- Payday Loans – That said, don’t make matters worse by getting a payday loan to solve your problem! With interest rates between 30-400%, these are serious trouble. Budgeting religiously will help you from having cash flow issues.

- Unnecessary coverage. Insurance is great in many cases, but I bet almost everyone I know is carrying too much insurance and buying insurance on things they don’t need (often tacked onto things like rental cars and mortgages). It’s a topic for another whole blog post, but try to find a reputable agent that can give you an honest appraisal of what you actually need.

- Rapid Refunds or Tax Prep in General – Rapid refunds (essentially a loan against your tax refund) are a huge waste of money, if you need a loan there are much better terms to be had. Also, paying for tax preperation when you don’t have a complicated scenario (i.e. you can just fill out a 1040ez) is easy enough you shouldn’t pay anyone to do it. There is also free tax prep software online believe it or not! TaxAct is one I’ve used in the past.

Spending money on anything of these things is a complete waste. You get no value nor enjoyment from them. Keep an eye out to avoid these charges and use the money instead to pay down debt and build savings.